Money on the Table: Opportunities Missed in the eBook Supply Chain

(This speech was presented at the Book Industry Study Group (BISG) Annual General Meeting on April 26, 2019 at the Harvard Club, New York, NY)

First, I’d like to thank you for inviting me here today and thank you to Brian O’Leary and his team both for this event and for all that they do at BISG. I would also like to give a shout out to Alyson Groves and Wendy Reid, who are our standards and metadata representatives and advocates at Kobo, to Dave Anderson, our outgoing BISG Board Member and Patricia Simoes, our incoming BISG Board Member. This is a talk, very appropriately for this audience, about metadata and why we need more and better, but along the way it is also about how being a retailer is changing and how that change amplifies the need for that metadata even more. So, a quick recap…

In 2009, we started a skunkworks project inside Indigo, the Canadian book retailer, to figure out how a retailer of physical books could compete in digital reading. We sold ebooks, raised some money, built devices, and created partnerships,

We got acquired by Rakuten, expanded all over the world and in no time at all it’s a decade later. In this town, we’re often thought of as “Kobo, who we wish would be bigger in the US” - which is fine — better saying something than nothing at all. But I have to say, it doesn’t bother us that much. Because while most eyes were on the US (and in most coverage of the sector, continue to be) we went outside of the US and grew a customer base of more than 35-million users, with a catalogue of more than 6-million books, selling in 190 countries, with localized bookstores in 12 languages and 25 countries and revenues pretty evenly split between Asia, the Americas and Europe. It has allowed us to avoid the ups and downs of individual markets, spread out investments across multiple territories, and catch new waves of digital growth when other markets become more mature. We have acquired businesses to grow scale, like the Tolino platform in Germany, we have rescued users from platforms that didn’t make it, and we have worked with our parent company on the acquisition of adjacent businesses like OverDrive, adding institutions and libraries to consumer sales.

We have - all of us in this room - lived through the cycle of digital disbelief, digital cautious interest, the great ePub conversion frenzy of 2009, the great digital publishing conference boom of 2010, that time in 2011 when we all bought summer homes for antitrust lawyers, agency, agency lite, agency classic, gluten free agency with Amazonian rainforest nuts.

And here we are today. A decade in, digital is a known quantity. For the past couple of years we’ve heard both publishers and retailers say things like “I think it’s going to be okay…” Publishers report eBook sales essentially plateauing in the US and the UK and adoption marching on a more gradual and steady through Europe, without the sudden panic-inducing leap that took place in English language markets.

More importantly, it seems the defenses designed to protect the publishing and bookselling industries have held. And if we read the statistics from the AAP, we reached the high water mark of ebooks a couple of years ago and now you can stop worrying about ebooks and focus on finding the right narrator for your audiobook version of the Joy of Cooking.

So, it would be easy to think at this point, that the big fights are over, that we can get back to publishing and selling books without having to worry about the industry remaking itself the way it did for music and video.

Well, you know what they say about Calm before the Storm.

I’d like to make an argument that we have entered what we consider the 5th wave of bookselling, almost without knowing it.

The first 4 everybody knows, so we can speed right through them.

If the first was independent bookselling.

And the second was big box and chain bookselling, which was directly linked with inventory management and advanced warehousing and logistics…

…Which in turn provided all of the infrastructure that was needed for the 3rd wave, when the internet got mixed with plentiful standardized metadata and wholesaling to create online bookstores…

[EBOOKS AND AUDIOBOOKS]

… Which could then be used as a sales platform when eInk, tablets and smartphones came along for ebooks and audiobooks.

So that gets us to #4. Each wave has been accompanied by a step up in metadata, with it becoming more and more mission critical each time, to the point where, as we get to ebooks, we are dealing solely with digital assets with global distribution and availability determined by the ONIX files that accompany epubs and cover images.

With agency, some publishers took direct control of pricing and found that they could partially manage the growth eBooks by managing the difference in price between print and digital, slowing or at least influencing the rate of adoption.

That in turn created a pricing gap that allowed independent authors and publishers to rush in and fill all of the space between Free and $4.99, shrinking the share of ebooks among traditional publishers and transforming self-publishing from a movement to an industry.

Each wave up until now has been about distribution — what gets sold, who sells it, how much it sells for, selection, format, together with a new competitive landscape.

The 5th wave of bookselling isn’t a format shift. And it isn’t a change in where books are sold or distributed. It isn’t subscription vs. single-title sales. Because this isn’t about how much a book gets sold for at all. This revolution in bookselling is about books vs. Everything Else.

We have found ourselves in the midst of an Attention Economy. The commodification and commercialization of attention. It is about the fight for time.

It would be easy to argue that books have always fought other forms of media for time, that TV, movies, magazines, newspapers, have always jockeyed for various shares of peoples’ day. And that is certainly true. But the moves were small, and measured in decades, discussed in terms of literacy, the number of people who read vs. the number who don’t or can’t.

Not any more. In the Attention Economy, thousands of very sophisticated companies, most of whom have nothing to do with books, or even media, have figured out how to make a lot of money packaging up your time. They have a very clear sense of what people’s time is worth, what they would like to do with it, and most importantly, have an incredible variety of tools and tactics to pursue and capture it. So as much as we look at Amazon or Apple as competitors, we focus at least as much on Netflix, Facebook, Instagram and YouTube.

Not just because they are popular and people use them, but because they look at the world through a fundamentally different lens than a book publisher or a retailer or a magazine. They are interested, above all other things, in engagement. In the consumption of time. Really they are interested in showing you ads, but the more time they have, the more ads they sell. And that means they have become expert in the psychology of creating compulsive feedback loops that sustain that engagement. And are willing to invest Manhattan Project-level amounts of talent and capital in making that happen - the best minds of a generation harnessed to the goal of sustaining attention for the purposes of online advertising.

We have never had competitors like this. No one has.

The challenge for Kobo is simple: how do we get someone reading and keep them reading, in the face of every other targeted, data-mined, algorithmically driven choice that is available to them? Not just sell a book. That was last decade’s fight. Now it’s a question of how we spark that impulse to read, capture it, and then once it has started, keep it burning for as long as possible while multi-billion dollar companies are doing everything they can do to blow it out.

At Kobo, we are doing our part. We have been gearing up for this fight for attention with ever more sophisticated combinations of human expertise and machine learning, creating algorithms to ever better predict what a person who is reading now might want to carry on reading, or read next, or reach into their busy days to remind them about something they are already reading to pull them back in. And then as best as we possibly can, get them to the next book or the next author, juggling that love of story or information and never letting it drop.

But we need help. That fight for attention requires help that only publishers can provide. And in helping us keep people engaged with books, publishers also help themselves, their authors and their titles by differentiating them from the millions of other titles out there.

Here are SIX things that could make life easier for us. Six places where publishers are leaving money on the table. Six examples where some of the publishers are doing some of it some of the time, but almost no publishers are doing all of it all of the time. And each one, if corrected, leads directly to more sales and greater visibility for a publisher’s titles.

And it all comes under the umbrella of one Big Ask...

Which is Better Metadata.

Which should be totally easy for this group! Everyone in this room loves metadata. The reason you are here instead of getting boozy with an author is because you love metadata that much. You know about it, and you use it, and you’re sending feeds to retailers like us regularly.

But you are leaving money on the table – really easy money – by not being laser-focused on what metadata in the ebook and audiobook context can do for you, especially when metadata is literally all that we have to figure out what book goes where and how to handle it. And where that sometimes means that someone goes and buys another book, it increasingly means that we could lose them for a week to watch Game of Thrones. Not just sales. Attention.

So here are six examples, some large, some small, of where sales and attention, get lost.

Local time for local sales

This first one is easy. It’s amazing how many publishers set their release times for midnight, New York time. No matter where the book is being sold. Even though pre-orders are huge everywhere - US, UK, and Australia. So set your releases for sensible times in different time zones, so Australians can receive their UK- or US-rights-dependent pre-orders before they arrive at work. A hot title can lose a day of sales simply because it isn’t available for purchase when it should be.

This may be the smallest point I make, but it is dear to us. If you lived in Australia wanted to buy the latest Dan Brown as soon as you possibly could, you’d be better to buy it in print. Because a bookstore will have the boxes open and the books on a table for opening bell. A digital bookstore won’t have that book for about a day -- and in that time, the attention of that would-be reader may have drifted to something else, and there is no guarantee that what they drift to will be a book at all.

So in the spirit of public service, our merchandiser for Australia wanted me to let you know that these books are, based on the data we have been given, going to miss their first day’s sales.

But it’s okay. These are small unknown authors that no one has heard of. I’m sure opening day sales aren’t a big deal. ;-)

2. Market-sensitive pricing

One of the things that drive us crazy is when publishers or even retailers say “We’re format agnostic now. We are happy to treat ebooks as just another format.” It sounds very liberated. You’re in an open relationship with formats now. But while print books are like that significant other who never gets a passport and stays close to home, eBooks are like that one you had a crush on in high school who is constantly going to exotic countries because their parents work for an airline and you hope some day you can go to Morocco together and get matching tattoos. Or maybe that’s just me. But what I’m getting at is that ebooks go everywhere that their metadata allows. But publishers so often neglect to look at the pricing in different markets and get a read on what good pricing looks like in different countries. Straight currency conversion almost never works. It always ends up too high or too low. Set up a process to review international prices instead of simply converting currencies and calling it a day. Review international prices and make sure you are locally competitive. Product gets overpriced all the time in India, Brazil and Mexico. Don’t worry about bleed over between territories. We’re good at selling the right thing in the right place. But you are losing out due to international sticker shock.

It’s even worse when errors get introduced, which happens more often than we’d like. At one imprint, a title was set at 7.00 Yen, or about 6.5 cents, rather than 700, which would have been about $6.50. The good news was, it became a bestseller. The bad news was that in the few days it took to catch this mistake, almost 15,000 copies were sold for total of $900 in revenue. Please be careful.

3. Use your rights.

And because ebooks are so fantastically easy to sell across borders, use your rights to sell everywhere you can. Fix your data to make those books available in all the countries open to you, not just here at home. Readers are everywhere, and even if you didn’t spend a cent on translation, English speaking readers are everywhere. Optimize your territory rights – as I said in the beginning, we sell into 190 countries, and English sells everywhere. So, a book shows up in the Economist or on CNN International, you could have a robust run in Taiwan, or Singapore or United Arab Emirates, all of which are surprisingly strong English markets for us.

Without really trying, we sold 600,000 different English titles in non-English countries last year. And we could have sold a lot more if books that we know have international rights were made available. Do an audit. Find out what’s missing. Because we can absolutely sell it.

4. Test price elasticity

When it comes to price, Don’t set it and forget it -- or only marginally better, set once for hardcover, with a price drop when it comes out in trade paper. Independent authors are eating big publishing’s lunch, tweaking their prices and testing price elasticity regularly. Price is a huge trigger for readers, and indies use it to trigger sales heat enough to float up bestseller lists and automated “what’s trending now” lists, to draw attention to their books. We automatically re-promote titles that have experienced price drops, giving them coveted space on home pages, recommended lists, and CRM email.

Here is an example from one of our independent authors, who plays around with pricing consistently.

Indie authors fill gaps in their publishing schedule with limited-time price drops, some of which drive higher net sales than new release weeks. Key takeaways: price elasticity, and keeping the backlist evergreen.

And sure, you could say that that’s fine for an independent author who only has a couple of series to take care of. But those authors are collectively eating into the digital share of larger publishers, so it’s worth thinking about how to increase the overall level of pricing activity.

Next, if you come away with only one message, from this whole presentation, from this whole day, please let it be this:

5. Add series data. Every damn time

This just hurts us. And hurts you. Series data is such a particular pain point for us, because it is a such a driver of sales. What’s amazing is that publishers encourage authors to write series because they know that series sell well, but then almost wilfully choose not to tell anyone it’s a series. It should be so simple, so natural, so easy a way to add to “discoverability” and yet it is one of the most abused fields in metadata. Publishers go on and on about discoverability. Well, this is the best kind of discoverability there is.

And let me just make it perfectly clear why it’s important to us.

Series represent a full 52% of sales.

Our high-value readers around the world spend somewhere between $100 and $1000 a month on books. Half of their libraries are devoted to series. 42% of our top customers have least two books by the same author. This is a loyal person who finds something she likes and then wants to keep reading the next and then the next, and yet series data is notoriously mangled.

To unleash this sales beast, all you have to do is populate series metadata in a way that is consistent *and* machine readable, which means using the same format across the whole series.

Think about it. If you published James Patterson, would you sometimes refer to him as Jake? Or Jimmy P? No, of course not. That would be confusing. But we see errors like this consistently, and we often get customer complaints that they can find books 1, 2, and 4, but 3 and 5 are attached to a different spelling of the same series.

Many publishers still don’t see the value of providing accurate, regular series metadata. At Kobo and some of our cleverer competitors, the series field is used to automatically group and sequence related titles; the ability to display to customers an entire series in order whether on an item page or in search drives sales. Better yet, it allows us to generate for you one of our highest converting customer messages, where just as a reader is getting to the end of a book we prompt them to buy the next in the series, to keep reading and not lose their attention. If we don’t know the next in the series, or don’t know it’s a series, Our push message will suggest something else, and then everyone is unhappy and that person goes off to crush four hours of YouTube videos and become an alt right internet troll and it’s all. Your. Fault.

Let me show you some examples of what we see, regularly.

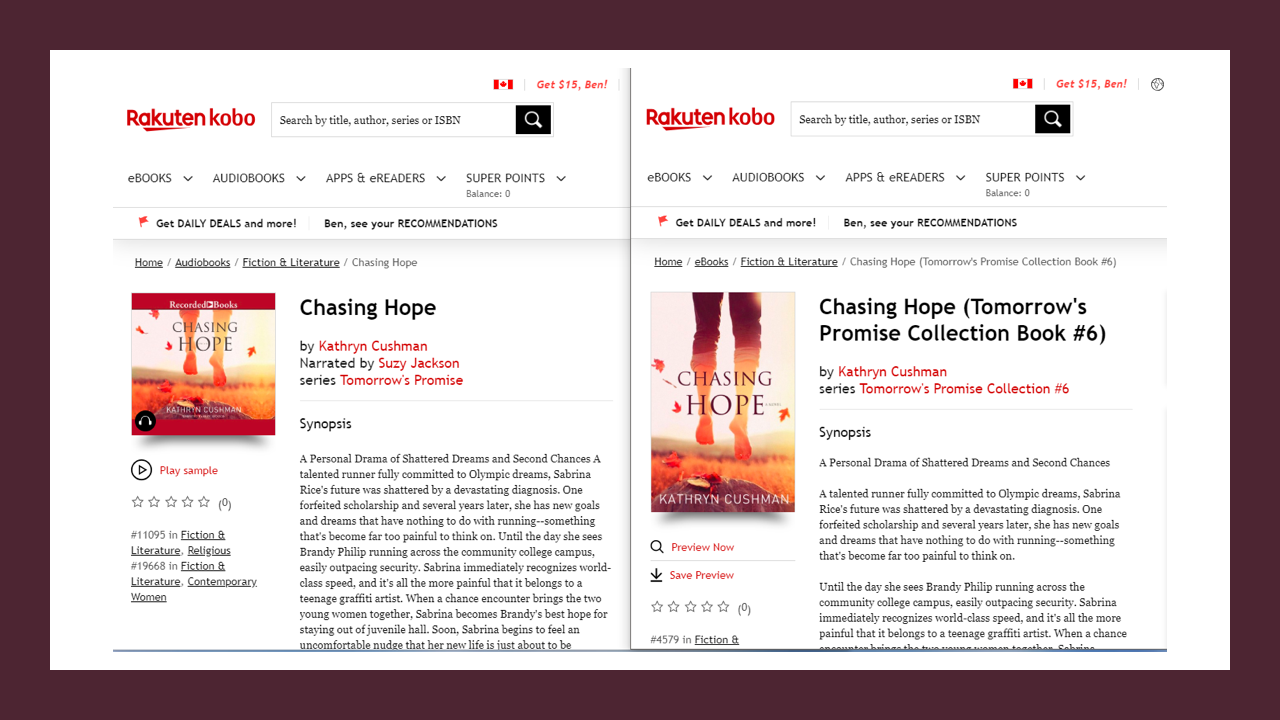

See the problems here? This is Book 17. Or maybe it’s book 1.

THE NAMES OF DEAD GIRLS SLIDE

We know the series and series number for the audiobook. But on the ebook we just get the series. This is either bad metadata or a bold experiment on the part of the publisher that the audiobooks should be listened to in a particular order, celebrating the linearity of storytelling, while the ebooks can be approached as a choose your own adventure experience and combined in any order.

Someone has it in for Philip Kerr. It isn’t us! These next few slides will show various forms of metadata torture being inflicted on poor Philip Kerr across the Bernie Gunther series. In this instance, the series info is in the subtitle.

Except for here, where the series information is in the title, there is no subtitle, and there is no series information listed. The title of the audio book is *The Other Side of Silence: Bernie Gunther, Book 11*It should be that the title of the book is *The Other Side of Silence*, the series is _Bernie Gunther_, and it's book 11. That’s making the title do a lot more work than any title should have to do.

Except for audiobook 8 which bucks all the trends. The title is correct, author and narrator correct, and the series information is correct.

So just to recap, based on this data, which we will probably end up fixing manually, we would drop the ball 4 times recommending books that a Philip Kerr fan would almost certainly read if we could put them in front of her in order. So please give now, and save Philip Kerr.

Even blockbusters are not immune. You may be surprised to know this book is part of a trilogy. But the publisher says no. This mockingjay stands alone.

And on the flip side here we have more of a belt and suspenders approach, just in case.

And believe me, we hear from customers when they can’t find book 3, or that few years’ old release from one of your prolific authors. We have a team of publisher operations people who spend all day every day making sure information is accurate, and filling in the blanks. But we can only correct what we know about.

On any given month, we receive between 500 and 600 requests from customers about books they were expecting to find but couldn’t. There are more than 5,000 titles in our system right now with missing series information that should be there, and this number is half of what it was a year ago, due to outreach and manual intervention from our publisher operations team. That means our team finding gaps, reaching out, following up, adding metadata by hand, and so on, so that we can ensure a reader can find the next book in your series. On top of that good metadata are built Recommendations, end-of-book experiences, themed lists, series recos, and so on. Help us bridge customers to next read.

And if your strategy is outsourcing your series metadata to volunteer editors at GoodReads, then remember you are benefiting exactly one retailer. So we wish you wouldn’t.

6. Power up your synopses.

One thing we don’t care about is keywords. They have been abused so badly without penalty that we have become very sceptical about them. And there are a lot of other ways to optimize our own search functionality without them. An SEO-approved or SEO smart synopsis can be as useful as any keyword composite. After all, if keywords are not worth including in your synopsis, how key are they?

If you are going to invest your effort somewhere, it’s a good idea to write synopses that do the double duty of providing decision- support to the customer who’s made it to your item page while also supplying differentiating language that can be used to help other customers along the same journey.

Indie authors care so much about optimizing their synopses, that even the biggest bestsellers pay $300 per blurb to a company (also run by indie authors) that focuses solely on copywriting eBook blurbs that are optimized to drive more sales. It turns out that when your synopsis is all you have to make a first impression on a reader, you care about it a lot.

And you can be sure that anything this guy writes isn’t going to include “Now for the first time in paperback” in a blurb about the ebook.

We urge you to get the basics right. That’s all. Then our own massive investments in discoverability, the customer data and big data and other forms of alchemy have a real chance to create connections between your books and the ideas or stories customers are actively engaging with, and together we have a chance at winning a fair share of attention in this very heated economy.

Up until now, we’ve been talking about support for existing businesses - audiobooks, a la carte ebooks. Let’s now talk about what’s coming next.

LIGHTBULB

In 2017 we launched our subscription service Kobo Plus in the Netherlands, despite the deep fears of publishers and the trepidation of our retail partner, bol.com. The reason we started there is because the Netherlands experiences, or experienced, a high rate of ebook piracy compared to the rest of Europe. It let us have the kinds of conversations with publishers that Spotify had with music publishers: if we worked with publishers and our retail partner Bol.com to create a business model where everyone gets a piece of the subscription pie, and we made an easy to use interface, a great reading experience, an affordable offering, great books on offer, we could bring some black market consumers back to the light, turn freegans into paygans as it were, so we could in turn pay the creators and publishers of content what they are rightfully owed.

The results have been surprising, and encouraging. Not only did we see swift uptake of our subscription model, we were pleased by what we didn’t see.

ESCALATOR SLIDE

We were worried there would be cannibalization, that if we had lots of great books and bestsellers in the subscription, no one would buy a la carte. It didn’t happen.

Single-books sales stabilized, and subscriptions now represents about 30% of our total sales in the Netherlands.

75% of those who try subscriptions with a free month convert to paid subscriptions.

What is notable here is that just about 30% of those subscribing to our service in the first year hadn’t bought a book in any format; and 60% hadn’t purchased an eBook before.

Of the a la carte customers we quote unquote lost, only 8% had purchased more than 100 euros in books previously in any format. So we turned low value customers into higher value customers.

Looking at the long term, as people get more and more comfortable with paying one price per month to enjoy as much of any form of entertainment they can handle, we need to think about how we might battle the fight for attention better, together.

Publishers are deeply worried about subscriptions diminishing the value of individual books. The risk used to be “Retailers are going to take our $25 product and devalue them into $10 products”. And thus agency.

Now the risk is that we have a whole generation of consumers who pay $10 a month for an infinite supply of music or video looks at a $20 book or a $15 ebook and says “not interested”.

We may be insulated for a time by the book purchasing demographic, older adults are more used to paying those prices and have strong emotional attachment to books but the younger generation, maybe not so much. 80 year olds are getting on streaming services and crushing hours of British crime dramas the same way my 16 year old binge watches Stranger Things, so the behavioural barriers are breaking down.

And that has us very interested in subscription services for books.

LADY ON SUBWAY

What does any of this have to do with metadata? As we know, it always comes back to metadata. Everything does.

As we have already seen from launching subscription services in other places, if we were to launch a subscription service in North America, we would have two options:

Build it to be ONIX compliant (subscriptions are doable with ONIX!) but that means ONIX 3.0. It’s still amazing to me how many major providers in North America can’t send ONIX 3.0 data but it is by far the best option as we start to get into a world where publishers want to quickly take titles in and out of subscription services.

Build a hacky, proprietary solution that doesn’t rely on ONIX, but contributes to the industry problem of providers needing to send data in multiple formats to multiple retailers.

Supporting new business models like subscriptions using ONIX 3.0 gets treated as a nice-to-have. And frankly, even I think it’s a nice to have, because I still want basics like series data and good on-sale dates. But it is starting to become necessary

When we look to launch new models, agile publishers will flood in to fill our catalogue and serve those customers. While many traditional publishers “experiment” and put a small handful of backlist titles into subscription services, small publishing operations using our Kobo Writing Life platform are taking up valuable placement, grabbing customer attention and market share, and realizing an upside that larger publishers are still pretending doesn’t exist. It’s just so much easier for the little operations to opt in--so they do, and they dominate.

The natural question is “why should I be making any greater investment than I already am in metadata for ebooks? EBook sales have gone to the dogs. The AAP tells me ebook sales are flat to down. Ebooks are just another format and I’m in an open, consensual relationship with all formats.

So let me tell you a secret, because we’re all metadata loving friends here. Making strategic decisions based on AAP ebook sales is like asking the Emperor Nero for fire fighting tips.

AAP ebook sales tracks self-reported ebook sales from traditional publishers. All of the growth in ebooks is happening outside of traditional publishers. None of it is on the AAP radar. Let me make this as clear as I possibly can.

1 in 4 of the ebooks we sell in North America are self-published, Indy-published, originals or exclusives. 25% of all ebook sales. That’s like having another Penguin Random House in the market that no one knows about. And they are growing double-digits every year while everyone else gets a little bit smaller.

Why are they growing? First and maybe most importantly, they colonized the space that agency opened up at $5 or less like the world’s friendliest Mongol horde. From that moment, traditional publisher share started dropping and independents started expanding. Second, they are fanatical about varying prices, jumping on promotional opportunities. They know that online bookselling is a world of algorithms and they are more than willing to surf them. They care less about author brands and more about being the best choice for a reader in that moment when they are deciding whether or not to try a book. Third, they are unafraid of new business models and new promotional tactics and will try just about anything if it means getting in front of a new reader. And fourth, they are scrupulous with metadata, especially series data that makes it easy for us to roll a reader from one book to another.

And you could say, sure, but those are 1 in 4 unit sales, not 1 in 4 revenue dollars. And that’s absolutely true. But a $4.99 book takes just as long to read as a $12.99 book and remember, we’re in a fight for time here.

You could also say, my print sales are generally stable and my ebook sales are only down a little bit, so clearly this isn’t affecting me.

I would argue that is, at best, a one-generation bet.

Does any thinking person in this room really believe that 50 years from now, with the combination of digital ubiquity, environmental and resource pressures, evolving distribution platforms and consumer demand, that we will be pressing ink on to dead trees for our stories? And if you believe 50, do you believe 25? If you believe 25, do you believe 15. 15 years ago there was no iPhone, Facebook, YouTube or Twitter.

Ashleigh Gardner and Wattpad are training an entire generation to be totally happy reading on screens. And we know that we’re picking them up as they exit their teen years and start looking for other things to read.

I don’t think it’s a stretch to suppose that for the next few decades, every innovation in how money is made from books will be operationalized through metadata. That's the paradigm now. And it's unlikely that the next paradigm will be less technically intensive.

That’s what makes what happens here at BISG so important. Being out in front of change, working together to figure it out and build systems and standards to manage it, is so much better than someone coming over the top and telling you what to do. It’s a place worth investing in to continue to future proof the industry and have tangible discussions about what we want the shape of that change to be.

2019 is Kobo’s tenth anniversary year. Netflix, ten years after it was founded in 1997, had delivered its billionth physical DVD and just announced that it was going to start doing streaming video, which was seen by shareholders as a distraction that might work for a tiny fraction of people but really, who was going to watch a movie on their computer.

I take heart in this story. Change is always slower than expected, then faster than expected. We are at most 10 years into a 25 year transformation in reading and there are still a lot of surprises to come. As a digital partner we want to work with you so you can focus on amazing creation, the stories and the ideas that have brought readers to us. But I also want to give those titles the best possible chance of finding that audience, and earning their time.

I ask you to consider what you are really up against, in the fight for time.

What goes in those ONIX files becomes the store that we present to the world. And we want it to be a great one.

Use what you have to get the attention you deserve.

Thank you.